-

13 min. read

13 min. read

-

Trevin Shirey

Trevin Shirey VP of Marketing

VP of Marketing

- Trevin serves as the VP of Marketing at WebFX. He has worked on over 450 marketing campaigns and has been building websites for over 25 years. His work has been featured by Search Engine Land, USA Today, Fast Company and Inc.

Every successful company and entrepreneur has at least some history of failure behind them. That’s because companies need to grow to operate long-term, and you can’t grow unless you try new ideas. Unfortunately, a lot of those ideas aren’t going to work.

In fact, some of them might seem like complete failures. Rough patches don’t just happen to small businesses either — plenty of big brands almost went bust before really hitting their stride. These are five household names (plus one honorable mention) that came close to losing it all before rebounding and what we can learn from their surprising success.

#1. Marvel Comics: Repurposing content

Today, everyone with access to television, movie theaters, or video games has heard of Marvel Comics — or, as it’s known today, Marvel Worldwide. But it wasn’t always the creative powerhouse that it is today. Founder Martin Goodman started Marvel in 1939, and it’s had its ups and downs ever since.

Today, everyone with access to television, movie theaters, or video games has heard of Marvel Comics — or, as it’s known today, Marvel Worldwide. But it wasn’t always the creative powerhouse that it is today. Founder Martin Goodman started Marvel in 1939, and it’s had its ups and downs ever since.

Spiderman, X-Men, Thor, the Avengers, the Fantastic Four, and the Guardians of the Galaxy are all Marvel properties, and their comics all sold enough to keep Marvel growing throughout most of the company’s history. But in 1993, the comics market bubble burst, and Marvel’s leadership couldn’t decide what to do next. After years of loss and indecision, they finally caught a break in a surprising new medium: Film.

While Marvel’s previous movies — like Howard the Duck — didn’t always work out, they had their share of hits, like Blade and X-Men. Still, Marvel only got a small percentage of the profits since outside studios made the films, and they couldn’t survive on such small profit margins. Eventually, Marvel struck a deal to stay afloat with Merrill Lynch, posting the rights to their iconic characters as collateral.

Under direction of president Kevin Feige, Marvel Studios produced a new line of popular films, including Spider-Man and Daredevil. Then, Disney bought the company for a $4.3 billion, and Marvel released The Avengers — one of only three films ever to gross more than $1 billion from ticket sales. Today, Marvel films are blockbuster hits almost every time, and Disney has almost definitely earned back its original investment — and then some.

Marvel’s lesson: Reworking old content can do wonders

Marvel succeeded because it took its old ideas and repurposed them into new content.

If Marvel hadn’t started its own production studio, it wouldn’t have achieved a fraction of the success it has today. After all, their brave steps into film arguably kickstarted the modern superhero film craze. It’s true that DC (Batman) and Dark Horse (The Mask) tried to cross the comics-to-film bridge before, but none of them quite had the appeal or earnings of Marvel’s turn-of-the-century smash hits, most notably X-Men.

With the right characters, writers, stories, and production, Marvel completely changed cinema — and superheroes — for good. Today, there’s a popular new superhero movie out every few months, and you can bet that whenever one is in theaters, there’s another one in production. And a huge part of that craze is thanks to Marvel taking a wild chance on the idea that their characters could succeed more on the silver screen than glossy stock.

#2. IBM: Returning to roots

At 104 years old, IBM is one of the oldest big brands in the country. International Business Machines Corporation made huge strides in the 20th Century in terms of technological R&D with almost all of its revenue coming from B2B sales and maintenance contracts. That’s because they were the industry leader in computer mainframes, and they could research, develop, manufacture, and maintain their products all at once.

At 104 years old, IBM is one of the oldest big brands in the country. International Business Machines Corporation made huge strides in the 20th Century in terms of technological R&D with almost all of its revenue coming from B2B sales and maintenance contracts. That’s because they were the industry leader in computer mainframes, and they could research, develop, manufacture, and maintain their products all at once.

IBM’s business model was solid — at least until 1993, when it started hemorrhaging money to the tune of $8.1 billion per year. Personal computers and client servers threw IBM an industry curveball, so they tried to compete in that market. But their high-priced machines couldn’t keep up with their competitors’ smaller, cheaper machines.

With the company on the brink of oblivion, IBM hired an outsider — Lou Gerstner — as CEO. He tried something completely radical: He listened to the company’s customers. Even without a background in computer science, Gerstner’s plan worked because he understood why customers came to IBM and what they wanted from the company.

As far as clients were concerned, IBM’s selling point was that they offered comprehensive, one-unit solutions. So Gerstner focused on that quality. Today, IBM’s stock is worth more than twice as much as 1983. And if it hadn’t been for Gerstner, this 100-year-old titan wouldn’t have made it to the 21st century.

IBMs lesson: Listen to your current customers

IBM’s strategy kept its head above water, and it even helped them become profitable. That’s the value of listening to your current customers. You know the products and services your company offers, but your customers know what brought them to your company, how your products helped, and why they still buy from you.

That’s why it’s so valuable to listen to them — they were once your potential customers, and they chose your business over your competitors. If you can figure out a reason, you can use it as a selling point to get more customers in the future. Send out a survey via email or social media to find out what they liked about your products or services in the first place and what keeps them coming back — especially if they’ve worked with your company year after year.

They’ll be able to tell you what drew them to you, why they bought from you, and why they continue to buy from you. With that information, you’ll understand your existing customers better and have the ability to reach more.

#3. Pittsburgh Penguins: Former employees

Mario Lemieux is a hockey legend. He played for the Pittsburgh Penguins for a whopping 17 seasons between 1984 and 2006, giving him one of the longest careers in the NHL. But a league lockout, combined with poor team management, left Lemieux’s beloved Penguins with two options in 1998: Move or call it quits. Lemieux leveraged his personal lawyer, agent, and paycheck to keep his favorite team from going under.

He played for the Pittsburgh Penguins for a whopping 17 seasons between 1984 and 2006, giving him one of the longest careers in the NHL. But a league lockout, combined with poor team management, left Lemieux’s beloved Penguins with two options in 1998: Move or call it quits. Lemieux leveraged his personal lawyer, agent, and paycheck to keep his favorite team from going under.

And that, combined with a series of smart business moves, helped Lemieux finally bring the team back to profitability. Since then, the Penguins are a regular league favorite in the NHL, and they even brought home the Stanley Cup win in 2009. But if they hadn’t inspired the loyalty and love of one of the team’s most famous players, it’s possible the Penguins would be across the country in Portland — if they existed at all.

Penguins’ lesson: Inspire and care for your employees

They may be a sports team, but the Pittsburgh Penguins are still a business. The moment they’re not profitable, they’re in danger of dying out just like any other company. That’s why their story is so valuable, especially for smaller businesses entering high-competition industries.

Your employees — or ex-employees — can play a direct role in the success of your company. That’s a whole new incentive to treat your employees well. And while you may not have a single employee who saves your company from bankruptcy, building a strong, reliable, and passionate team in your business is essential.

Every employee you hire is another potential solution in the future and an investment in your company.

#4. Nintendo: Creating the perfect product at the perfect time

Nintendo was founded in Japan in 1889. It first produced handmade playing cards, and today it’s one of the most profitable games companies in the world. But Nintendo wasn’t always the gaming powerhouse that it is today. In fact, the company almost went out of business just 30 years ago.

Nintendo was founded in Japan in 1889. It first produced handmade playing cards, and today it’s one of the most profitable games companies in the world. But Nintendo wasn’t always the gaming powerhouse that it is today. In fact, the company almost went out of business just 30 years ago.

Following the introduction of their Family Computer Disk System (or “Famicom”) to the North American market, Nintendo faced some hard times that threatened to sink the company. But in September 1985, they rebounded with perhaps the most famous video game of all time: Super Mario Bros. A collapsed video game market in the United States meant high Western demand for quality games, but no supply to match. This gave Nintendo an untouched goldmine of consumer interest.

With a little marketing magic, Nintendo tested the American market by releasing their new game in select cities to thunderous success. The rest is pretty much history. Nintendo has churned out profitable Mario games on a regular basis, and their Italian plumber mascot is a big reason that Nintendo became the industry powerhouse that it is today.

And it all came down to one game that they released at the perfect moment.

Nintendo’s lesson: Timing is critical

The timing of Super Mario Bros. played a major role in its reception by consumers. If the video game industry hadn’t just collapsed from an influx of high-price, low-quality products, Nintendo wouldn’t have had the market vacuum that led to its modern success.

That collapse destroyed hundreds of competing companies that flooded the video game market too, which meant Nintendo’s quality games could stand out on the shelves. On the flip side, the gaming community was naturally suspicious of anything new on the market — a lot of the games over the past few years wound up being high-priced junk. Regardless, if another company would’ve released a quality game at the same time, Nintendo wouldn’t have had the market domination that earned it so much revenue.

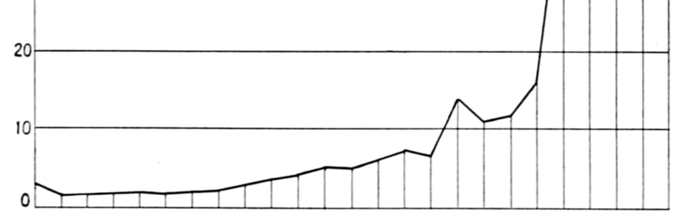

And if Nintendo had restricted Mario and Luigi to a Japanese release, who knows where they would be today. But they took a risk on a down market that just so happened to have a huge demand — even if consumers were suspicious — and very little supply. And as of 2014, Nintendo has so much money in the bank that it could run a deficit for almost four decades without ever closing its doors.

That’s quite a rebound.

#5. Apple: Compassionate competition

Apple was a completely different company in the 1990s. In fact, in 1997, Apple didn’t have enough money to make it out of the 1990s. A series of product failures and general bad product moves brought the company dangerously close to destruction. To stay afloat, they offered non-voting stock shares at about $8 a pop, basically asking the public for a loan.

In fact, in 1997, Apple didn’t have enough money to make it out of the 1990s. A series of product failures and general bad product moves brought the company dangerously close to destruction. To stay afloat, they offered non-voting stock shares at about $8 a pop, basically asking the public for a loan.

In one of the most compassionate corporate moves ever, Microsoft took Apple up on their offer. Microsoft bought $150 million of Apple’s stock to keep the struggling tech company alive, which upset fans of both brands, but ultimately worked. It also looked like Microsoft wanted to set up a trust or monopoly on computer products, but fortunately that didn’t happen.

Today, that investment sounds like chump change compared to Apple’s $700 billion net worth. But without it, Apple wouldn’t be worth anything at all.

Apple’s lesson: Rivalries don’t have to be hateful

This is probably one of the strangest business moves ever made by direct competitors. Typically, when a competitor is struggling, the smart thing to do is to buy them out, acquire their worthwhile talent, and ditch the parts of the brand that don’t work.

Instead, Microsoft opted to buy non-voting stock, giving them no control over Apple’s actual behavior. Then, they sold their shares by 2003. Functionally, Apple pretty much took out a loan — they just took it from Microsoft instead of a bank.

Part of the reason for the sale was probably that Microsoft didn’t want to deal with anti-trust litigation. But if they would’ve held onto that stock, Microsoft could’ve made $4.5 billion. The takeaway here is that business doesn’t always have to be cutthroat.

In Steve Jobs’s own words:

“We have to let go of a few notions here. We have to let go of the notion that for Apple to win, Microsoft needs to lose.”

On the one hand, that sounds like the beginnings of a trust or a monopoly. On the other hand, it’s also reassuring to see that business doesn’t have to mean attacking your competitors and bleeding them dry.

Without that one-time buy-in from Microsoft, the tech industry simply wouldn’t be the same today. Neither would the mobile phone market, the tablet market, the wearable computer market, or the music industry. And possibly the world as a whole.

Apple’s had a huge hand in all of them. And without their influence, the world would be a very different place.

Honorable mention. FedEx: Literal luck

In the 1970s, FedEx was losing $1 million per month because of fuel costs.

In the 1970s, FedEx was losing $1 million per month because of fuel costs.

Frederick W. Smith gambled the company’s last $5000 on blackjack, and, literally against all odds, he won. Smith stashed his winnings — $32,000 — in the company’s bank account, which bought the company some time.

Over the next few days, he secured $11 million in investment capital. He literally gambled his business and won.

FedEx’s lesson: When you have nothing left to lose, take a risk

The reason FedEx is an honorable mention is because its story is incredible — even the short version — but its methods aren’t repeatable (or advisable). In fact, this scenario is so lucky that it probably wouldn’t work for any other company at any other time.

Ever. Casino gambling is carefully orchestrated to make sure the house always wins. That means Smith didn’t do anything groundbreaking — he just got lucky.

But in another sense, luck plays a role in the beginning of so many successful companies. That luck could be getting new investors (which Smith also did) or hiring someone who turns out to be a rising industry star. In that sense, every business owner takes a gamble at one point or another.

But most of the time it’s not a game of blackjack.

Have you had to bounce a company back?

Have you ever had to bring a company back from the edge of bankruptcy? How’d you do it, and what advice do you have for other business owners? Let me know in the comments!

-

Trevin serves as the VP of Marketing at WebFX. He has worked on over 450 marketing campaigns and has been building websites for over 25 years. His work has been featured by Search Engine Land, USA Today, Fast Company and Inc.

Trevin serves as the VP of Marketing at WebFX. He has worked on over 450 marketing campaigns and has been building websites for over 25 years. His work has been featured by Search Engine Land, USA Today, Fast Company and Inc. -

WebFX is a full-service marketing agency with 1,100+ client reviews and a 4.9-star rating on Clutch! Find out how our expert team and revenue-accelerating tech can drive results for you! Learn more

Try our free Marketing Calculator

Craft a tailored online marketing strategy! Utilize our free Internet marketing calculator for a custom plan based on your location, reach, timeframe, and budget.

Plan Your Marketing Budget

Maximize Your Marketing ROI

Claim your free eBook packed with proven strategies to boost your marketing efforts.

Get the GuideTry our free Marketing Calculator

Craft a tailored online marketing strategy! Utilize our free Internet marketing calculator for a custom plan based on your location, reach, timeframe, and budget.

Plan Your Marketing Budget