- Home

- Blog

- Social Media What’s Your Social Credit Score? [Infographic]

What’s Your Social Credit Score? [Infographic]

-

4 min. read

4 min. read

-

WebFX Team

WebFX Team Digital Marketing Agency

Digital Marketing Agency

- The WebFX team is made up of more than 450 subject matter experts in digital marketing, SEO, web design and web development, social media, and more. Together, they’ve helped WebFX’s clients earn more than $3 billion in revenue from the web — and that’s just in the past five years. @webfx

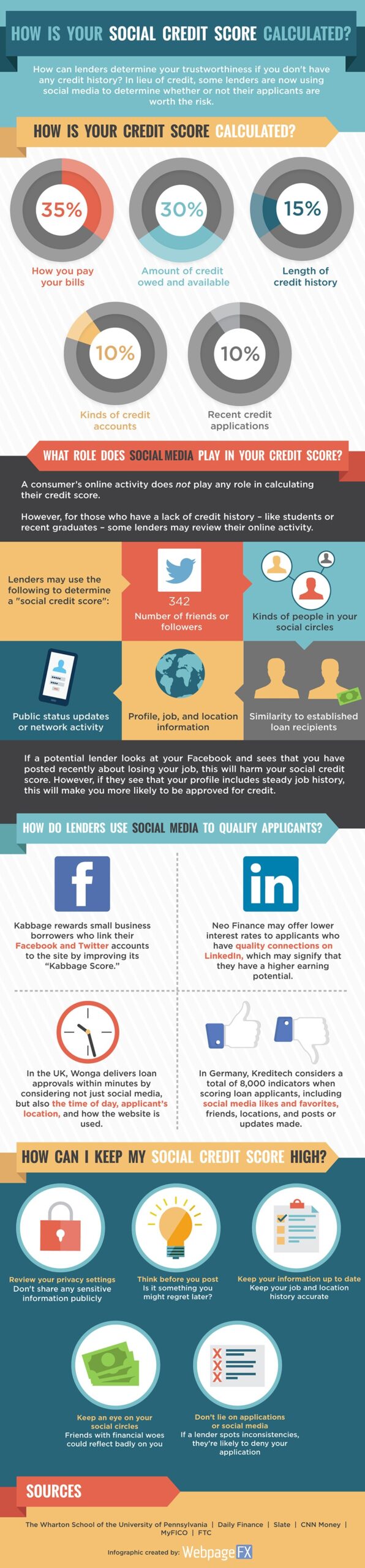

Can your social media activity play a role in determining your credit score? At the moment, credit scores in the US are determined by five factors, none of which have anything to do with your online activity. However, according to a report from the Wall Street Journal, some lenders are beginning to use Facebook and other social media sites to verify the identities or worthiness of loan or credit applicants.

Surprisingly, for some lenders, this kind of behavior is nothing new. Read on to learn how some companies are using your social media profiles or activity to determine whether or not you have a high “social credit score” and are worth the risk of a loan.

Share This Graphic On Your Site

According to research done by The Wharton School of the University of Pennsylvania, there are a growing number of credit companies using social media data to assess the credit risk of applicants. Kabbage, Neo Finance, Wonga, and Kreditech are only a few of the lenders that have adopted this practice.

According to research done by The Wharton School of the University of Pennsylvania, there are a growing number of credit companies using social media data to assess the credit risk of applicants. Kabbage, Neo Finance, Wonga, and Kreditech are only a few of the lenders that have adopted this practice.

Curious to know what role your social media activity plays in determining your creditworthiness? Here’s how it works: let’s say you apply for a loan with one of these four companies. They’ll begin by checking traditional factors (like your FICO credit score, employment status, amount of money owed to other lenders, and so on).

If there are any red flags, or you have limited credit history, lenders are more likely to refer to your public online activity — including your social media profiles — to determine whether or not you are worth the risk.  From there, the lender will make an assumption about how much of a risk you are based on what information is publicly available. Generally speaking, an individual with several hundred Twitter followers, high quality connections (like managers, COOs, presidents, etc.) on LinkedIn, and public posts about recently obtaining a new job or promotion will likely be seen as a worthwhile risk.

From there, the lender will make an assumption about how much of a risk you are based on what information is publicly available. Generally speaking, an individual with several hundred Twitter followers, high quality connections (like managers, COOs, presidents, etc.) on LinkedIn, and public posts about recently obtaining a new job or promotion will likely be seen as a worthwhile risk.

On the other hand, someone with no LinkedIn profile, dozens of Facebook friends posting publicly on their wall about partying, and a spotty job history won’t be as likely to receive approval. And if you’ve just posted about quitting your job and telling off your boss, well… let’s just say you’re not getting a loan anytime soon.

If you’re concerned about lenders reviewing your social media activity for use in loan or credit line decisions, here are a few tips:

- Check your privacy settings before you post anything that might be sensitive or frame you in a negative way.

- Don’t post anything you might regret later. Do you really need to tweet about everything that upsets you?

- Keep your job history and other information up to date. If you’ve worked somewhere for 3 years but your profiles only say 6 months, you’re less likely to be approved, especially if there’s a discrepancy between your application and the data you provide.

- Keep your friends — and only your friends — close. Some lenders may check their database to see if they’ve loaned to your social media contacts in the past. If one of your Facebook “friends” is a deadbeat, you’re probably going to be seen as a deadbeat by association. You may want to cut ties with any high school acquaintances who can’t seem to get their act together, just in case…

When it comes to your social media activity, there’s one important thing to keep in mind: it’s not just lenders who may check up on you. Current and future employers, industry figureheads, competitors, or even your relatives and friends can easily find your online activity and scope out what you’ve been up to or what you’ve been saying. As tempting as it may be to share every last bit of your life online, stop and think beforehand: “is this necessary?” If the answer is “no,” it might be best to keep it to yourself.

When it comes to your social media activity, there’s one important thing to keep in mind: it’s not just lenders who may check up on you. Current and future employers, industry figureheads, competitors, or even your relatives and friends can easily find your online activity and scope out what you’ve been up to or what you’ve been saying. As tempting as it may be to share every last bit of your life online, stop and think beforehand: “is this necessary?” If the answer is “no,” it might be best to keep it to yourself.

That way, you’ll not only keep your social credit score high, but also make your online presence look polished and professional, which has benefits far beyond loans and credit applications. Photo Credit: Fosforix, Marc Wathieu

-

The WebFX team is made up of more than 450 subject matter experts in digital marketing, SEO, web design and web development, social media, and more. Together, they’ve helped WebFX’s clients earn more than $3 billion in revenue from the web — and that’s just in the past five years.@webfx

The WebFX team is made up of more than 450 subject matter experts in digital marketing, SEO, web design and web development, social media, and more. Together, they’ve helped WebFX’s clients earn more than $3 billion in revenue from the web — and that’s just in the past five years.@webfx -

WebFX is a full-service marketing agency with 1,100+ client reviews and a 4.9-star rating on Clutch! Find out how our expert team and revenue-accelerating tech can drive results for you! Learn more

Twitter and Facebook Status Generator

Finding engaging social media content for your business can be difficult. Use our tool to quickly find ideas and post directly to your page.

Give Me an Idea

Social Media Cost Calculator

Use our free tool to get a free, instant quote in under 60 seconds.

View Social Media CalculatorTwitter and Facebook Status Generator

Finding engaging social media content for your business can be difficult. Use our tool to quickly find ideas and post directly to your page.

Give Me an Idea